When a Big Week Goes Wrong: How to Protect Your Bankroll and Your Head

A practical guide to bankroll discipline, tilt control, and betting with clarity when variance hits hardest.

Imagine marking 40 years since your first bet and then watching a single day wipe out a week of careful work. It’s a humbling reminder that variance is real, and even experienced bettors hit walls. That sting — the “I did everything right but still lost” feeling — is the exact moment your process either breaks or proves its value.

Mindset First: Treat losing weeks as data, not destiny

Summary: Losses feel personal, but they’re often just variance interacting with imperfect information. The quickest upgrade you can make is to separate emotion from process.

Breakdown:

Expect downswings. Large tournaments and long multi-day events concentrate variance. Four days is a terrible sample size for long-term ROI.

Tilt is real and contagious. The instant response to a bad result — bigger bets to “get even” or shrinking stakes in panic — ruins expected value more reliably than a bad tip.

Reframe: a losing week = feedback loop. Ask what you can test and quantify next time. Which assumptions failed? Market movement, starting problems, or misread form?

Bankroll rules that survive shocks

Summary: The right bank rules make bad weeks survivable and good weeks scalable.

Concrete rules to implement:

Predefine your tournament bank. Decide the total you’ll commit to March-style action and treat it as separate from everyday funds.

Define “bad-day” and “good-day” scenarios up front. Example: if you lose X% of tournament bank on Day 1, reduce max stakes by 50% on Day 2; if you gain Y%, keep stakes flat to avoid chasing winners.

Use simple staking: flat or proportional. Flat units are easiest to execute under stress. Proportional staking (fixed % of current bank) protects longevity but requires discipline.

Plan for liquidity and limits. If exchanges and bookmakers can limit you, have backup accounts and a smaller set of priority bets — decide which you still want to chase if prices drift.

How to set your bets so psychology doesn’t wreck the plan

Summary: Decide BEFORE kickoff. Write it down. Execution becomes almost mechanical.

Tactics:

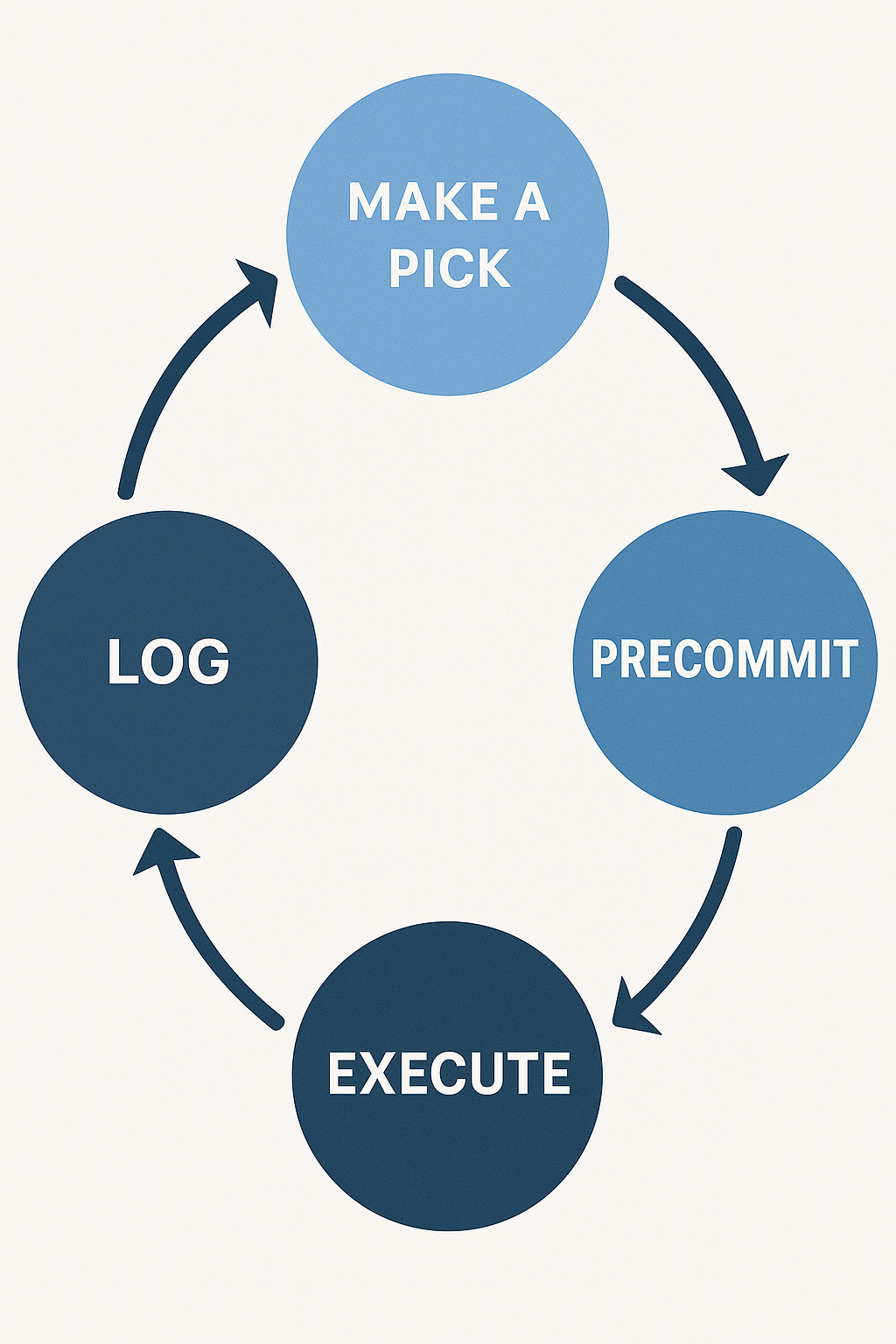

Precommit list: Pick the matches/races and stake sizes before the event. Put them in a spreadsheet or app.

Priority order: Rank your bets by conviction. If you can only afford 6 bets but have 20 options, the ranking tells you what to keep.

Reserve liquidity: Keep a small reserve for late-value opportunities or to re-enter if early losses were due to short-term variance.

In-running discipline: Define rules for in-play action (e.g., max fraction of bank for any single in-play bet, or avoid in-play unless a specific trigger happens).

Read the market, but don’t be hostage to it

Summary: Big events move markets dramatically. Understanding why a price moved is different from reacting to the move.

Key considerations:

Large liquidity moves happen for reasons outside your model (liquid syndicates, new information, bet-limits). A 6/1 → 3/1 swing on a big market may not invalidate your edge; it may simply reflect stakes hitting the book.

If your ROI strategy is high-edge but low-capacity, expect closure. If you prefer longevity and scale, accept lower edges in more liquid markets. That’s a conscious tradeoff.

Document major price drifts and the reason you either followed or ignored them — over time this becomes invaluable calibration data.

Practical rules to stop loss-chasing

Summary: Chasing losses is predictable and preventable. Put procedural brakes in place.

Simple procedural brakes:

Stop-loss rule for the session: e.g., stop for the day after losing N consecutive units or X% of your session bank.

Cooldown period: After a defined stop-loss, require a 1–2 hour cooling-off before placing any further bets. Use that time to re-check data, not Twitter.

Account-level limits: If a bookmaker restricts you, don’t view it as a personal affront — adjust strategy or move to alternatives instead of trying to force the same bet at worse prices.

Accountability: Keep a running log of every session’s outcomes and one-sentence read on why things broke or held up.

Tactical checklist you can use for any multi-day event

Decide total tournament bank and unit size

Pre-list your bets and conviction ranking the night before Day 1

Define day-by-day stop-loss and escalation rules (exact % or number of units)

Reserve 10–20% of the bankroll for late value or re-entry if allowed

Log every trade immediately: stake, odds taken, book/exchange, reason

After each day: quick review — what surprised you? Did any market moves invalidate assumptions?

The long view: ROI vs capacity tradeoff

Summary: Two common approaches exist and both are valid — choose one and stick to it.

Approach A — High-edge, low-capacity: Hunt for big inefficiencies and accept short windows before limits close you out. Higher ROI per bet, less sustainable at scale.

Approach B — Lower-edge, high-capacity: Play liquid markets with more money accepted and longer longevity. Lower per-bet ROI, but better for a business model.

Actionable: Pick your default approach and keep a small “opportunity” fund for the occasional high-edge shot.

🎯 The Bottom Line

Bad weeks happen to everyone. The difference between a short-term disaster and long-term success is a calm, pre-specified process: bankroll definitions, precommitted bets, documented rules to prevent tilt, and a clear stance on ROI vs capacity. If you treat losses as data and protect your capital with rules, the variance becomes survivable and your edge has a chance to matter.

📲 To make this easier, use Bet Journal. It helps you track your bankroll, log every bet, and review your performance with clear insights — so your process is structured and your decisions are sharper.